Previously on

MoreLiver’s:

Follow ‘MoreLiver’

on Twitter

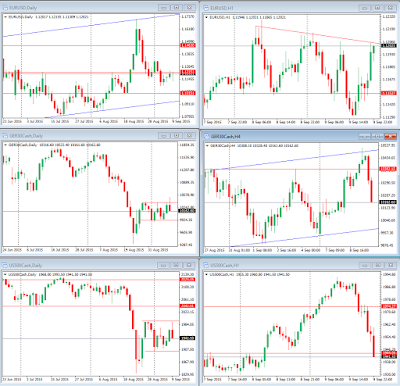

Markets still range-trading ahead of the next week's meeting of the Federal Reserve:

EUROPE

Michael Heise: Should

Germany Leave the Euro? – Project

Syndicate

The

debate over whether Greece should leave the eurozone has revived the idea that

Germany, and other similarly strong economies, would do the rest of the

continent a favor if they were the ones to leave the monetary union. It is an

idea that is shortsighted, impractical, and economically dubious.

JUNCKER SPEECH

State of the Union

2015: Time for Honesty, Unity and Solidarity – EU

Refugee Crisis:

European Commission takes decisive action – EU

Greece

must respect bailout, or EU reaction will be 'different': Juncker – Reuters

EU's

Juncker says in favor of treasury for euro zone – Reuters

Juncker

proposes enlarged refugee scheme for Europe – FT

Migrant

crisis: EU's Juncker announces refugee quota plan – BBC

What

You Need to Know About Europe's Refugee Crisis: Q&A – BB

850,000

to cross into Europe: U.N. – Reuters

Juncker

urges ‘immediate action’ on migration – Politico

What

Juncker said, what he meant – Politico

By

the numbers: Juncker’s State of the Union – Politico

Juncker’s

revamped refugee plan – Open

Europe

Juncker

still has some explaining to do – Politico

UNITED STATES

US Economic Outlook:

Solid demand side - weak supply side – Nordea

Our updated view on the US economy remains very positive. Solid domestic

fundamentals imply that a stronger USD and even a hard landing in China will

not derail the economy’s good growth prospects. The Fed is likely to prefer

gradualism over aggression when lifting rates. However, weaknesses on the

supply side suggest that rising inflation pressures could prompt a disruptive market

shock with spill-overs to the global economy.

FEDERAL RESERVE

The Fed Is About To

Unleash Deflation: Deutsche Bank Shows How – ZH

Interest rate rise:

economic indicators mean hard choices for Fed – FT

Economic hotspots emerge across US economy despite sluggish wage growth

The Fed Must Act Soon?

Why? – Mark

Thoma

OTHER

Buiter: Only

"Helicopter Money" Can Save The World From The Next Recession – ZH

Era of low interest

rates fails to generate growth policymakers expected – FT

Nearly seven years after the central bank cut rates to near-zero,

policymakers from the Fed’s crisis-era response team say low rates and

quantitative easing have failed to generate the vigorous economic bounceback

they expected.

REGULARS

Morning MoneyBeat Asia – WSJ

Stocks Rally, Catching

Up to Europe, Asia

Morning MoneyBeat Europe – WSJ

Stocks Jump As Investors

Adjust to China Fears

Morning MoneyBeat US – WSJ

Watch the Fear Gauge

Closely

Danske Daily – Danske

Bank

Euro rates update – Nordea

Eye-Opener – Nordea

Positive market mood;

China suggests less control ahead; US markets catch-up * US JOLTS report to

confirm strengthening labour market * US Treasury yields rise * USD mixed

Morning Markets – TF

The will they, won't

they debate just got ratcheted up another notch after World Bank chief

economist Kaushik Basu urged the US Federal Reserve to save emerging markets

from "panic and turmoil" by not moving on interest rates next week.

Daily FX Comment – Marc

Chandler

Dollar Bid, but

Antipodeans Firm

Daily Press Summary – Open

Europe

Commission President: EU

cannot continue with “business as usual” it is not in a “good situation” * Spain

signals U-turn on refugee quota system while Poland remains opposed * Osborne:

The EU treaties do not provide enough protection for non-euro countries * Rebel

MPs seek ban on Conservative party money in EU campaign and free role for

ministers * Politico: European Commission to launch new €26 million publicity

campaign to promote the EU * Leader of Greek centrist party ready to govern

“even with the devil” to achieve stability * Bloomberg: Eurozone bailout fund

used to indirectly finance bridge loan to Greece * Polish President: We should

hold referendum before joining euro * Catalan President: Upcoming regional

election “not about declaring independence immediately”

Brussels Playbook – Politico

EU goes Mad Men —

GE-whiz — State of the Union driving the day

US Open – ZH

Global Risk-On Euphoria:

Japan's Nikkei Soars 7.7%, Biggest One Day Move In Seven Years; Futures Surge

Frontrunning – ZH

The Swiss franc has tested new lows

against the euro since the January revaluation as a new surge in risk appetite

punishes the long-neglected franc. Elsewhere, commodity currencies have been

rewarded the most in this environment, though the Bank of Canada and Reserve

Bank of New Zealand might spoil their chances for further strength.

This week has seen

risk-on sentiment make a triumphant return to world equity markets, but Saxo's

strategists remain guarded as to how long it plans to stay. "We're not out

of the woods yet", say both Ole Hansen and Peter Garnry.

FINNISH

Aamukatsaus – Nordea

Euroalueen toisen neljänneksen BKT-lukuja korjattiin

ylöspäin | Turvasatamakorot nousivat eilen | Saksan vienti kasvoi heinäkuussa

Tätä

Suomi yrittää - näin talous singahti kasvuun entisissä kriisimaissa –

Verkkouutiset

Suomi on vajonnut yhdeksi euroalueen heikoimmin

pärjääväksi maaksi talouskasvulla mitattuna.

Entä

jos ulkomaillakaan ei mene hyvin? – Peter

Nyberg

Joustavuus

ja sopimusvapaus – Roger Wessman

Syyrian

sodan ratkaiseminen ei lopettaisi EU:n pakolaistulvaa –

Professorin

ajatuksia

Juncker

esittää EU-maille pakollista maahanmuuttokiintiötä –

Verkkouutiset

EU

julkisti suunnitelmansa turvapaikanhakijoiden maakiintiöistä –

YLE

Juncker:

Turvapaikanhakijoiden sijoittaminen tehtävä pakolliseksi –

YLE