|

| Source: Wiki |

Good morning! Past weekend’s two deaths have put me in a surprisingly good mood. No-one will miss the Dear Leader – except (maybe) his family and lovers of status quo. Of course, succession plays are always question marks and what the markets really don’t want right now is more uncertainties. Risk-off in Asian equities and nervous meetings in White House's situation room and whatever they have in Beijing and Seoul.

Many will miss Havel, including me, but in a way he became immortal long ago. His peaceful, intellectually honest approach set an example that is now quoted and remembered as he has passed away. Havel's way is something that the world needs right now maybe more than ever.

|

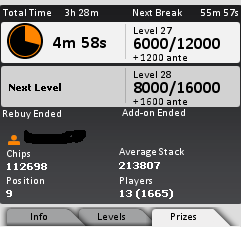

| I ended in second place (Hold'em NL) |

– MoreLiver

News (Mon morning) – BTH

News – The Trader

EM headlines (Mon morning) – beyondbrics / FT

Morning Preview – Saxo Bank

review of the year part 1

FX option vols – Saxo

Markets Live – alphaville / FT

Debt crisis: live – The Telegraph

Europe Crisis Tracker – WSJ

EURO CRISIS

1) no ECB sovereign backstop, 2) no European joint bond and 3) no euro zone break up.

Many economists and investors see a binary outcome of the European debt crisis: either the ECB backstops the sovereign/there is a European bond, or the euro zone breaks up. Instead, we think that the continuation of what can be called “muddling through” is the most likely scenario for the period ahead.

Downward Spiral – Foreign Policy

Europe's crisis is morphing again -- for the third time in only 12 months -- and the implications for the global economy are even more complex, unsettling, and troubling.

Political Realities Threaten To Split The Eurozone – Testosterone Pit

If this scenario were to play out, the Eurozone could crack into groups of countries: one clustered around Germany, another around France, with a few countries perhaps falling by the wayside. The EU too might fissure as Britain and a few other countries drift away.

If Italy is too big to fail and too big to save, how can it save itself? This column suggests a survival strategy. The Italian households should finance their own government by buying its debt, and the ECB should prevent a collapse of the Italian banking system.

If a PSI deal is not agreed with significant take-up by February, Greece could face a hard default.

Imagining a brutal post-euro world – Pragmatic Capitalism

You are asleep, tucked snugly in bed in New York. It is 2:00 a.m. on Monday morning. Suddenly the phone rings, and it’s the office cell phone. You are shocked out of bed. Your heart is racing. When that phone rings at that time of the morning, it cannot be a good thing.

ECB

Goldman's Take On TARGET2 And How The Bundesbank Will Suffer Massive Losses If The Eurozone Fails – ZH

GS: It is only if one or several countries were to decide to leave the Euro area that the imbalances would lead to potentially significant losses beyond the risk already reflected in the current generous liquidity provision through the ECB.

GS: It is only if one or several countries were to decide to leave the Euro area that the imbalances would lead to potentially significant losses beyond the risk already reflected in the current generous liquidity provision through the ECB.

Draghi warns on eurozone break-up – FT

Mario Draghi has warned of the costs of a eurozone break-up, breaching a taboo for a president of the ECB, even as he sought to play down market expectations about the ECB’s role in combating the sovereign debt crisis.

Stark and Draghi on the haters – alphaville / FT

What the ECB is hoping to achieve from the LTRO? Interfluidity: The ECB would have the power to manufacture fiscal crises for a misbehaving state at will, and with marvelous deniability.

EU vs. UK

EU Leaders Endlessly Play "Ring-Around-the-Rosie"; Finance Ministers Seek IMF Funding Deal; EU demands £25bn lifeline from the UK – Mish’s

Furthermore, if the UK does not pony up, I strongly suspect they will not be alone. Finally, any nation that does pony up on the basis it is a "loan" should have full expectation the word is really "gift" as defaults are coming.

VIEWS

Deutsche On QE3, It's $800bn Or Bust! – ZH

the current dislocation suggests another full QE2-style package of about $800bn is already priced into the market

Bob Janjuah Answers The Six Biggest Questions Heading Into 2012 – ZH

Nomura: a recovery is expected into H2 on rather modest policy easing globally. However, it is precisely at this point that some important transitions will occur, as already referred to – the US, China and, indeed, the shaping of the EU’s new governance structure.

The bull case for stocks – Humble Student of The Markets

I have been quite bearish in these pages lately. As an antidote and to help me think critically, I outline what could go right for the markets in 2012, along with the risks - CB liquidity injections, QE3, ECB’s stealth QE (LTRO)

CHINA

The No. 1 Problem of the Chinese Economy – Gordon Chang / Forbes

The leadership either underestimates the crisis, believes they cannot do much or political transition interferes with efforts. It could be late 2014 before new leadership is functionable.

I hope that I’m being needlessly alarmist here. But it’s impossible not to be worried: China’s story just sounds too much like the crack-ups we’ve already seen elsewhere.

THE MAN & THE MIDGET

Remembering Vaclav Havel (1936-2011) – Chovanec / EconoMonitor

On his last weekday in Prague Castle as the President of the Czech Republic, Václav Havel taped a brief farewell address to the nation and then took a telephone call from George Bush.

The Intellectual and Politics – Vaclav Havel / Project Syndicate

Václav Havel, who died on December 18, was that rare intellectual who, rather than forcing his way into politics, had politics forced upon him. In 1998, while serving as President of the Czech Republic, he offered the following reflection on the benefits and dangers of his career path.

Politics and Theatre – Vaclav Havel / Project Syndicate

In March 1997, while serving as President of the Czech Republic, Václav Havel – who died on December 18th -- offered the following assessment of the intersection of politics and playwriting in his life.

Václav Havel’s Life in Truth – Jiří Pehe / Project Syndicate

he was one of the last of a now-extinct breed of politicians who could lead effectively in extraordinary times, because their first commitment was to common decency and the common good, not to holding power. If the world is to make it through its various crises successfully, his legacy must remain alive.

Keep on Rockin' in the Free World – Reason

How the Velvet Underground and Václav Havel built a blueprint for toppling totalitarians and other censors

Kim Jong-il “Is Dead” – The Diplomat

What Comes After Kim Jong-il? – The Diplomat

The reported death of North Korean leader Kim Jong-il is already leaving people wondering about whether his son, Kim Jong-un, is ready for power.

Alone In the Dark (2003) – The New Yorker

Kim Jong Il plays a canny game with South Korea and the U.S.

The details are complex, but follow them through to the end and you will see all of the problems of our system — political corruption, excess leverage, focus on short-term profit at the expense of survival — in one sordid affair.

Efforts to Shed Light on High Frequency Trading – allaboutalpha

CFTC’s year-end meeting discussed how to define and classify HF trades for monitoring their impact

Organised crime has long been big business in the country. But are mafiosi now enjoying protection by the state?

Risk Pragmatics – Quantivity

Household’s beliefs and financial decisions – Kézdi & Willis / voxeu.org

How to ordinary people form their beliefs about the economy? These beliefs then shape the decisions they make and can, if widely held, prove to be self-fulfilling. This column looks at surveys of ordinary people in the US and finds that the beliefs people hold and the reasons behind them vary almost as much as the outcomes they try to predict.

DIVERSION

A Curated Linkfest For The Smartest People On The Web – Simoleon Sense

Is It Irrational To Give Gifts? – Farnam Street

The Science of Why We Don’t Believe Science – Farnam Street