Tuesday, September 30

Monday, September 29

Sunday, September 28

Saturday, September 27

27th Sep - W/E: Weekly Support

Here are

the links to the weekly roundups, reviews and also previews of the beginning

week. Last week's 'Support' here.

27th Sep - W/E: Charts

|

| Plenty of downside left in the German stock index - at least to the lower end of the trading range. |

|

| US positive surprise index has turned down from high levels (expect negative surprises in the near future), while Euro zone negative surprises are largely behind us now. |

|

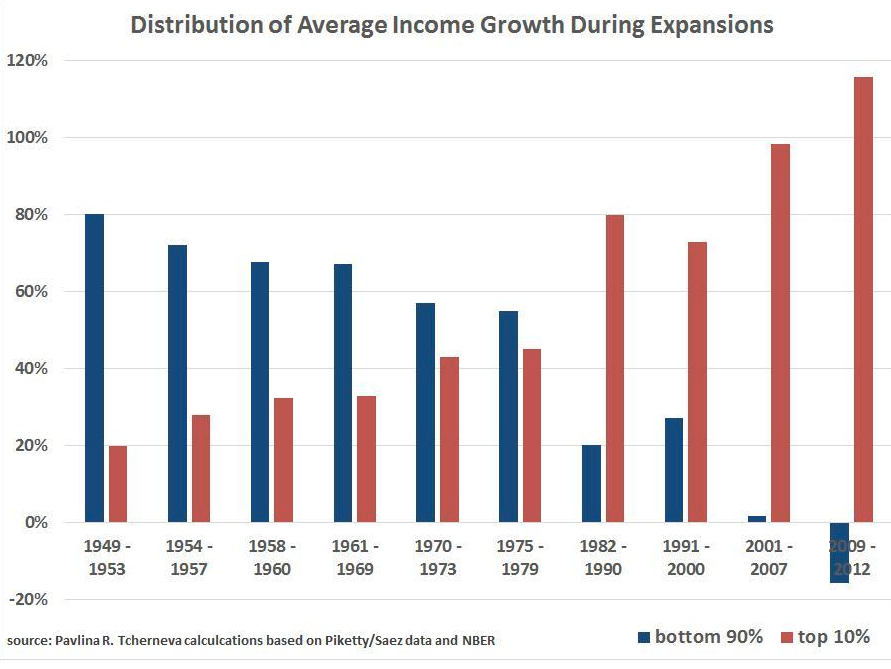

| During the past two expansions, only the better-off minority has seen an increase in their income - and the trend remains clear. |

|

| European purchasing manager indices did not show any growth ahead |

|

| The euro's weakness after the ECB's threats and plans of further monetary policy easing have largely been against the USD. Against AUD, JPY etc, the net change is zero. |

|

| Greece's stock index looks technically bad, but from a bit lower levels could provide a nice quick swing trade higher. |

27th Sep - W/E: Best of the Week

Here are

the best picks from my ending week’s posts. Bottom line & summary: Ukrainian crisis not going anywhere, growth outlook in Europe remains terrible, ECB's QE doubted.

Friday, September 26

Thursday, September 25

Wednesday, September 24

Tuesday, September 23

Monday, September 22

Sunday, September 21

21st Sep - W/E: Weekly Support

Here are

the links to the weekly roundups, reviews and also previews of the beginning

week. Last week's 'Support' here.

Friday, September 19

Thursday, September 18

Wednesday, September 17

Tuesday, September 16

Monday, September 15

Sunday, September 14

Saturday, September 13

14th Sep - W/E: Weekly Support

Here are

the links to the weekly roundups, reviews and also previews of the beginning

week. Last week's 'Support' here.

Thursday, September 11

Tuesday, September 9

Monday, September 8

Sunday, September 7

Saturday, September 6

6th Sep - W/E: Weekly Support

Here are

the links to the weekly roundups, reviews and also previews of the beginning

week. Last week's 'Support' here.

Friday, September 5

Thursday, September 4

Wednesday, September 3

Tuesday, September 2

2nd Sep - Credit Guest: The European Catharsis

Here is the latest from Macronomics, kindly cross-posted to MoreLiver's.

Monday, September 1

Subscribe to:

Posts (Atom)