Break until Tuesday night, sorry!

Monday, October 31

Saturday, October 29

Best of The Week

Here are this week's previously highlighted links. Earlier today I posted the Weekender - The Summit Hangover extra-large linkfest. Have fun, leave a comment, follow me on Twitter, Facebook or email me.

Reposting to other websites is authorized by prominently displaying the following sentence, including the hyperlink to this page, at the beginning or end of the post:

"”Best of The Week” is republished with permission of MoreLiver’s Daily."

"”Best of The Week” is republished with permission of MoreLiver’s Daily."

EURO CRISIS

Taking over the European Central Bank puts Mario Draghi in a position as perilous as Europe’s – The Economist

Weekender - The Summit Hangover

This week we had The Summit that was supposed to draw the road map to stop the rot, end the contagion, introduce stabeletee, increase confidence etc. The main goals were backstopping the banks and sovereigns and admitting the truth on Greece. The three pillars we got were the ‘voluntary’ Greek haircut, the bank recap and a sovereign debt guarantee under the Clancy-like acronym EFSF. All of these pillars are weak.

Friday, October 28

Guest Post: Long faith - Short hope and more on revamped EFSF

Good morning! An excellent credit overview after the euro summit-induced risk-on rally. Standard linkfest is at the bottom. Please note that I have previously posted Pre-Summit and Summit Autopsy Part 1 and Part 2. My next posts will be a Weekender-link fest and a Best of The Week on Saturday. Have a good weekend, follow me on Twitter, Facebook or email me. -"MoreLiver"

Guest Post: Markets update - Credit by Macronomics

Long faith - Short hope and more on revamped EFSF

"To withdraw is not to run away, and to stay is no wise action, when there's more reason to fear than to hope."

Miguel De Cervantes

Epic capitulation in the Credit space CDS wised. Both dealers and clients were short credit via CDS and basically everyone ran for the hills and the short squeeze was massive. Most of the action was in the CDS space, from single names, to credit indices, to sovereign CDS. In this long post, we will first review today's price action as well as revisiting EFSF revamped and risk it entails.

Guest Post: Markets update - Credit by Macronomics

Long faith - Short hope and more on revamped EFSF

"To withdraw is not to run away, and to stay is no wise action, when there's more reason to fear than to hope."

Miguel De Cervantes

Epic capitulation in the Credit space CDS wised. Both dealers and clients were short credit via CDS and basically everyone ran for the hills and the short squeeze was massive. Most of the action was in the CDS space, from single names, to credit indices, to sovereign CDS. In this long post, we will first review today's price action as well as revisiting EFSF revamped and risk it entails.

Thursday, October 27

28th Oct - Summit Autopsy Part II

|

| Source |

News (Thu evening) – BTH

News (Fri morning) – BTH (online Fri morning)

Danske Daily – Danske Markets (online Fri morning)

FX option vols – Saxo

TV: Bloomberg, CNBC, BBC World News

Markets Live – alphaville FT

|

| This is from SG's Edwards' research note. |

Debt crisis: live – The Telegraph

EZ crisis Live blog – The World / FT

EURO CRISIS

Joschka Fischer, Germany’s formin and vice-chancellor from 1998 to 2005: It was believed at the time that formalized rules – imposing mandatory limits on deficits, debt, and inflation – would be enough. But this foundation of rules turned out to be an illusion: principles always need the support of power; otherwise they cannot stand the test of reality.

27th Oct - Summit Autopsy

|

| "It's life, Jim, but not as we know it". Source |

The 50% haircut (seen as 15% cash, 35% bond exchange yielding 6% rather than 15%+ currently) would help to bring Greece’s debt down to 120% of GDP (in line with Merkel’s earlier comments) while the EFSF would be leveraged 4-5 times to approximately EUR1 tln. With regard to timing, the new EFSF framework is expected to be in place by end-November, a second Greek aid package by end-of-year with the bond swap likely in January. – Saxo Bank

Wednesday, October 26

26th Oct - The Summit

|

| Knowledge is income, income is knowledge |

Still breathing after a full day of psychometric testing. An old piece of advice on how to deal with nosy reporters: make sure you are recording. When you are asked for a comment, say that you will only provide background commentary and can be quoted only unnamed. If the journalist (foolishly) accepts, then say “no comments”. Now they have nothing to quote and can’t even put down “did not want to comment” attached to your name. Nice! I am back to regular postings tomorrow. Enjoy the show!

Videofeed from Eurosummit Press Conference 22:00 – europa.eu

Tuesday, October 25

25th Oct - Voight-Kampff interruption

|

| Guide to Euro Crisis, source: New York Times |

For today and tomorrow, I am cutting down on blogging as I'm going through psychometric evaluation for a job I would like to have. Some links, but I've omitted the summaries. Maybe an evening post later today, but no morning post on Wed. Good luck! - 'MoreLiver'

Monday, October 24

24th Oct - The summit makes me a sad panda

|

| van Rompuy spoke to the UN |

|

| Source: oftwominds |

The “news” coming out of the mouths of the bureaucrats is not encouraging. Seems like there is no agreement on how to solve the crisis. The means to solve it are limited and all choices boil down to pain. Pain can be faced in the short run or the long run and shared by all or only some. The bureaucrats would like to avoid pain, and if possible, kick the can.

Mr. Market would prefer

Saturday, October 22

Best of The Week

Here are my Best of The Week-links. Please notice that I earlier posted a Weekender, listing all the possible analysis and thinking on the European end game and Wednesday’s summit + week ahead/week in review-links. Follow “MoreLiver” on Twitter, Facebook or email me.

EURO CRISIS

A framework for assessing a eurozone rescue – Humble Student of The Markets

Excellent post. What needs to be done, what is credible and what is possible.

Weekender - Fellowship of the Dim

|

| Notice the price on the cover: 4.11 DEM. Source: Z |

Other institutions not to trust based on these links: central banks, banking regulators and auditors. Today only the The Californian prison gang "Mexican Mafia" and somewhat surprisingly the credit rating agencies can be trusted. But to French "banks" both of them are the same.

Friday, October 21

21st Oct - In case of fire

|

| In case of fire... |

Quote of the Day: “#eurozone: I've reported 9 years here in Brussels and never known such a palpable sense of despair, even doom, signing off..” – @BrunoBrussels (Bruno Waterfield), The Telegraph’s Brussels correspondent on Twitter

Thursday, October 20

20th Oct - End the game

|

| Finish the game. Source |

Summary: Weekend's main event is coming, drafts with little content are circulating, the chasm between the French soft line (because they're broke) and the German hard line (because it's their money) is probably much more intense than what we are told. Some commentators expect Merkel to cave in on Sarkozy's "solidarity" demands, but she knows that bailing out the French banks is not really an election winning strategy for her, might be unconstitutional and against the EU Treaty.

Of course, Sarkozy's line would guarantee him another term as a president, but I don't think Germans would be happy to pay his campaign bill. There is one reason why Merkel could surrender - the imminent threat of French sovereign credit downgrade, as that would kill the EFSF and any hope of finding other solutions except full transfer union or breakup.

20th Oct - Greece can give 200%

| ||

| All your EFSF money are belong to us. |

Summary: Today the usual euro “Plan” articles, with focus on the bank recap plans. The current sentiment is more of the same, too little, too late and the key problems ignored. I find it difficult for the leaders to put together anything that would convince the markets – except a full unconditional backstop by the ECB, and it is not a realistic expectation at the moment. Yesterday’s evening post might be worth your time.

Quote of the Day: A clear lesson is that even rapid economic growth cannot be maintained unless it is inclusive, creates jobs for the growing labor force, and is accompanied by social policies for the most vulnerable. For economic reforms to be sustainable, their gains must be broadly shared, not just captured by a privileged few. Widespread corruption is not just an unacceptable affront to the dignity of citizens, it also deprives them of the economic benefits. And the absence of transparent and fair rules of the game will inevitably undermine inclusive growth. – What the Arab Spring Has Taught Us – iMFdirect

Did you at first think the above quote came from an angry blogger supporting OWS? Someone against the moral hazards of international banking or the Euro? Think about it for a second. Is it because you know this also relates to Western developed countries?

Wednesday, October 19

19th Oct - Crash anniversary

Summary: 24th anniversary of the '87 stock market crash. Let the video to the right take you back to unforgettable music, hairdo's and shoulder toppings. By the way, over the past 30 years, bonds have returned more than stocks. Thanks a lot for Finance 101 courses.

Quote of the Day: EMU is not sustainable. It's really simple: You can't have a club (any kind of club) where people can consistently break all the rules. Then there is no more club. The only question is whether some countries will leave or whether the whole thing will slowly dig itself a deeper and deeper hole. I'm betting on the former: people with something to lose will always have an incentive to protect what they have. Greece doesn't have anything to lose anyway, so they'll go along with whatever idiocy is proposed next. – “FDAXHunter” Nov 2010

19th Oct - Rumors Part XVI

|

| My precious! |

Summary: Rumors of the “EU plan denied, European Commission raids banks in look for EURIBOR collusion, CDS short selling partial bans to Europe, Spain’s rating cut while the French were warned.

Quote of the Day: “Everyone is entitled to their own opinion - but not their own facts.” – Senator Daniel Patrick Moynihan

Tuesday, October 18

18th Oct - Truth hurts? Ban it.

|

| No more naked shorts! |

Summary: European bans for naked short CDS in the pipelines done. Regarding the big huge final solution (“Death Star”/ Super EFSF), the eurocrats are disagreeing in public, EFSF leverage effectiveness and legality are questioned by analysts. Even the Greek haircut level is still in the open. By the way, even a 50% cut in the Greek debt is not enough, as a lot of the debt is from IMF (super-senior). Someone recently calculated that to get an effective 50% debt cut, those debts that can be cut, should be cut by 100%. Merry Christmas! EDIT: Apple missed.

18th Oct - Links & Credit Guest

Summary: Very good reads today. Yesterday I posted "These are not the plans you are looking for", and today a guest post by Martin from Macronomics. First the links, have fun, feed me with a comment, follow "MoreLiver" on Twitter, Facebook or email me.

News (Mon evening) – BTH

News (Tue morning) – BTH

Danske Daily – Danske Bank (pdf)

FX option vols – Saxo

TV: Bloomberg, CNBC, BBC World News

Markets Live – alphaville FT

Debt crisis: live – The Telegraph

EZ crisis Live blog – The World / FT

EURO CRISIS

Peter Tchir: “what do they hope to get by banning naked shorts? They expect CDS to tighten. That will likely be the initial reaction. They expect a tightening in CDS to lead to improved purchases for bonds. That is unlikely to occur.”

Monday, October 17

17 Oct - These are not the plans you are looking for

|

| European battle plan. Source |

Summary: Just one post today, I’ve been busy with two university courses from Stanford during the weekend. I posted a Weekender on Saturday – including all the week in review/ahead-links plus a longer editorial, and Best of The Week, which is simply a collection of that week’s best reads I’ve featured. I am soon updating the Occupy Wall Street link collection. A new one in the regular daily features below is a link to Danske Bank’s daily market report. Today the links in Diversions at the bottom are really good – I recommend that you take a look. I still hope I find time to put the Benford’s Law-post together.

Have fun! – “MoreLiver”

Have fun! – “MoreLiver”

Quote of the Day: The two candidates have around six months to convince France that they are not the men they appeared to be. Then the French public will vote on who put on the best show.” – WSJ on France’s presidential elections

Saturday, October 15

Weekender - Compressors and Disco

Editorial: Very interesting tug-of-war going on – everybody agrees that something has to be done, but agreeing on what to do seems to be difficult. Until ECB capitulates, I don’t think there will be a lasting solution. On that note it is interesting that Trichet already warned the French government not to take the role of the central bank on the Dexia’s bailout. Trichet knows that the French AAA credit rating is in danger. If the French rating is cut, the EFSF is in trouble before it has even properly started.

There are signs that the ECB is realizing its input in addition to the bond purchases is needed, but it is still in the negotiation phase – the Greek haircuts would hurt the Target-holdings of the Euro System and require additional capital. ECB is not willing to only give, it requires something in exchange, as they do not want to carry the full political burden of the bailouts alone.

Friday, October 14

14th Oct - Risk on, what's wrong

|

| The decline in air cargo volume is not good news. |

Belgium is joining the PIIGS, at least based on one metric – their CDS curve is becoming inverted. Lifted from ZeroHedge. Great stuff, Dexia! 5Y, 10Y, and 5/10's CDS prices:

ITALY 452/462 +11 439.5/453.5 -16/-1

SPAIN 383/393 +6 368/384 -13/-3

PORTUGAL 140/1180 +25 875/945 -280/-220

IRELAND 740/770 +20 590/660 -160/-100

GREECE 60/62 +0.5 60/64 -0.5/2.5

BELGIUM 314/324 +15 311/325 -6/4

FRANCE 182/186 +7 197.5/207.5 16/21

AUSTRIA 167/175 +5 180.5/190.5 12/17

UK 92.5/96.5 +2.5 107.5/113. 14/18

GERMANY 94/97 +1.5 112.5/118.5 17/21

14th Oct - All the best, Silvio!

Summary: Short post for now, again posted away all my material yesterday: China in your hand and End The Market Correlation. The #OWS has been updated. I will post later today, and on Saturday will post a Weekender with more thematic picks (stocks, Benford’s Law) and a Best of the Week – picks from this week’s posts. Feed me with a comment, follow me on Twitter, Facebook or email me.

Quote of the day: Howard Buffett said his father, billionaire Warren Buffett, plans to work until death leading Berkshire Hathaway Inc. and isn’t considering retirement. “That word is not in his vocabulary, he says when he goes to the grave he will communicate with us via Ouija board.” – BB

Thursday, October 13

13th Oct - End The Market Correlation

|

| Source |

Summary: EFSF ratified, next open issue is the bank recapitalization. Banks don’t want to as their stock prices are low and recap would dilute current owners – they’d rather shrink their balance sheets to meet the criteria from EBA, and that would mean credit crunch. This is going to be the main news driver over the coming days, ahead of the G20.

|

| Source |

Current plan: EFSF, bank recap, Greek default and then full backstop from ECB and sovereigns. But the CDS prices of European financials and sovereigns are still moving up – or are the banks that have sold them short just covering to avoid the disclosure embarrassment of Erste? Either that, or the markets are not trusting the eurocrats’ plan. If so, the recent risk-on fun in equity space could end soon.

13th Oct - China in your hand

|

| Debt levels, summing public+corp. Source |

Summary: The risk-on trade in anticipation of the euro bazooka has gone a lot further than I expected. Equities can still be seen as being range-bound and at the top of the range – EURUSD has gone up more than I’m comfortable with. Today’s links include a lot on China and the stock market. I’ve previously posted a credit guest post. Yesterday I published an #OWS collection, Euro ‘Death Star’ and Brother, can you spare a yield?, which revolutionary included some of my own analysis. Feed me with a comment, follow me on Twitter, Facebook or email me.

Quote of the Day: Message to Barroso and other EU clowns: The German supreme court already rejected a permanent mechanism and it also rejected use of leverage. Even were that not the case, Slovak shows what happens to governments when they try to force things through. German Chancellor Angela Merkel will fall, the Italian Prime Minister will fall, as will the Greek Prime Minister, and perhaps French president Nicolas Sarkozy falls. What part of that do you fail to understand? There is no magic bullet and the Eurozone will not survive intact. – Mish’s

Guest Post: Credit overview by Macronomics

Guest post by Macronomics:

Markets update - Credit - Long hope - Short faith, Hungary and Bank Recapitalization

“A good solution applied with vigor now is better than a perfect

solution applied ten minutes later.”

General George S. Patton

Call it a bear squeeze or a short squeeze, the action today in the credit space is clearly pointing to short covering with some players capitulating and forced to cover their short positions in both Corporate Single names CDS as well as in some credit indices.

Regardless of how you call it, given the short bias of the street, some got hurt pretty bad probably today, not helping their profit and loss trading account in the process.

So yes, another long post, looking slightly at the periphery with Hungarian mortgages and approaching the hot subject of Bank recapitalization and the somewhat apparent issue of raising equity.

solution applied ten minutes later.”

General George S. Patton

Call it a bear squeeze or a short squeeze, the action today in the credit space is clearly pointing to short covering with some players capitulating and forced to cover their short positions in both Corporate Single names CDS as well as in some credit indices.

Regardless of how you call it, given the short bias of the street, some got hurt pretty bad probably today, not helping their profit and loss trading account in the process.

So yes, another long post, looking slightly at the periphery with Hungarian mortgages and approaching the hot subject of Bank recapitalization and the somewhat apparent issue of raising equity.

Wednesday, October 12

Occupy Wall Street Collection

|

| Source |

The probability of Europe getting its own version of Arab Spring is not zero anymore. I’ll just coin the word now. It will be Europe’s Fall. It will start with the general discontent towards austerity programs that we’ve already seen: demonstrations in Greece, Spain and soon Italy, followed by strikes.

Then the voters in core countries will understand that the PIIGS are not going to get their act together, and that the core’s leaders are about to indebt their countries by supporting the PIIGS, no matter what. Then it’s the core’s time to take it to the streets and market squares. After a mixture of solutions ranging from the riot police to premature elections, something will happen – Japanification of the core, eurofederalism or disintegration. But the current Europe will have fallen. - MoreLiver's Daily on 7th August

1st October

Wall Street Protest Starting to Look Like Egypt – Washington’s Blog

12th Oct - Under construction: "Death Star"

Summary: Fast markets, I will post aonther later today with more commentary. It looks like there is a Death Star in the works.

EURO CRISIS

Soros: “Specifically, they are talking about recapitalizing the banking system, rather than guaranteeing it. And they want to do it on a country-by-country basis, rather than on the basis of the eurozone as a whole. There is a good reason for this: Germany does not want to pay for recapitalizing French banks. But, while Chancellor Angela Merkel is justified in insisting on this, it is driving her in the wrong direction.”

We, concerned Europeans – alphaville / FT

A plea to solve the mess now, signed by 96 people including Soros.

A Finnish view on Greek debt losses – alphaville / FT

“did Finland short-change itself by accepting collateral good for only a 40 per cent loss? (At least it’s making plans for default though.)”

12th Oct - Brother, can you spare a yield?

Summary: Middle East getting interesting, Slovakia said no but will vote again and say yes, and even if it says no the EFSF will still go ahead. Democracy at its finest! I stopped including OWS links and will later post a dedicated, continually updated page for that, similar to the Steve Jobs post. Feed me with a comment, follow me on Twitter, Facebook or email me.

Summary: Middle East getting interesting, Slovakia said no but will vote again and say yes, and even if it says no the EFSF will still go ahead. Democracy at its finest! I stopped including OWS links and will later post a dedicated, continually updated page for that, similar to the Steve Jobs post. Feed me with a comment, follow me on Twitter, Facebook or email me. Notice the two pictures here - some of my analysis work from the past. Would you like to see more?

Tuesday, October 11

Guest Post: Greece and the Poor + linkfest

Guest post by Mr Hannu Visti, translation by MoreLiver:

Greece and the poor

A word on Greece based on this article from BBC. The Greeks are very, very angry that “wrong” people end up picking up the bill – the common Greeks.

I understand this kind of anger in countries where the taxpayers have to fund banks that have offloaded their balance sheets to Greece. The middle class in Germany can righteously moan about being put to pay in one way or another the risks taken by the banks. It does not matter to them if they end up paying via worse public services, higher taxes or increased debt that has to be serviced later, they still end up picking up the bill.

11th Oct - My shortest post ever

Summary: Short post now, as yesterday I posted so much. For new visitors, a good place to start is my new weekly post Best of The Week. Slovakia’s vote on EFSF coming soon, the last country to ratify the pact. Here’s some older background reading: The Economist, WP, Spiegel, Reuters, FT

Yesterday I wrote an email to Richard Sulik, the main opponent in Slovakia to EFSF ratification: Thank you for being a man and a patriot of your country. Maybe you can save my country's public finances, as our own politicians are not up to the task. Please help our country by trying your utmost to convince the parliament to vote no. For your sake, for our sake, for the whole Europe's sake.

Slovakian EFSF schedule:

9am - the Prime Minister meets leaders of four ruling parties to inform them of her next political move

10am - the leadership of the SaS party holds an internal debate

13pm - the parliamentary session on EFSF expansion begins

Monday, October 10

10th Oct - Coming out of the closets

|

| From Macro Man's excellent post. |

Summary: I’ve written a longer editorial in my previous post and there have been a lot of material to review, so just a quick summary: huge risk-on-day, given the news. I guess the coming out of the closet by Erste is deemed just as positive as Dexia’s fall. At least banks are starting to acknowledge the fact that there are indeed skeletons in their closets and strange warts in their intimate parts (naked short CDS’s etc) that they are finally showing to their family doctor – namely investors, regulators and eventual bail-outers.

Admitting that there is a problem is a step to the right direction – but I am afraid markets are too carried away by the Merkel/Sarkozy announcement of a later announcement of a plan.One thing supporting the theory that now they are at least trying: Europe's evil grand vizir van Rompuy decided to move the next Eurocouncil meeting by a week.

10th Oct - Announcement of a plan of a plan

Summary: Dexia has fallen again and it will be split and Belgium acquires other half. Hopefully Dexia will not continue doing more of the same for a third time. Belgium will inject capital to its half and will probably get downgraded later for it – 4bn euros and a 60% guarantee is heavy. France is scared it will be downgraded later when its turn to throw taxpayers’ money to Dexia comes. This was predicted on 6th Aug by Peter Tchir: .

“If France loses its AAA rating, the EFSF doesn’t work as structured.

Saturday, October 8

Best of The Week

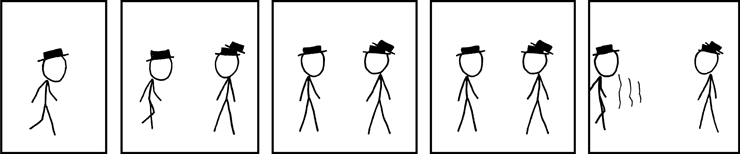

|

| Source: For everything else, there is xkcd |

8th Oct Weekender

|

| "The eurocrats got too greedy and dug too deep" |

Views: EURUSD and equity markets were on Friday sitting at the top of their trading ranges. If no concrete plans come out from the EZ and given the cuts in credit ratings, we probably see a swift “risk-off” in early parts of the week. Tuesday’s EFSF vote in Slovakia is the key event for the week. Expect rumors of rumors, contradictory statements and grand plans from the eurocrats during the week.

Friday, October 7

7th Oct - I'd buy that for a dollar

Summary: Bank recapitalization is clearly in the works, but will it be done through ECB (outside democratic power, so politicians love it, but ECB hates it), EFSF (not enough) or at national levels (politicians hate that). Markets are “happy” at Dexia’s failure, as it might be enough to push eurocrats to do what has to be done, irrespective of coming elections somewhere. I previously linked to a DIY stress test calculator. Steve Jobs updated, follow me on Twitter and Facebook, or email me. Buy Aaron Brown's book – you have until G20 meeting to comply.

Views: EURUSD at a channel top, while US equity at range top. Time to sell today. Monday might be too late. Original views here and here.

For the Friday, some laughs from this video. Not safe for work! Strong language, fiscal analysis.

TV: Bloomberg, CNBC, BBC World News

Markets Live – alphaville FT

Debt crisis: live – The Telegraph

Eurozone crisis: live blog – FT

Debt crisis Live Blog – The Source / WSJ

7th Oct - Failure is not an option

After today’s earlier guest post, here comes the first linkfest for today. Steve Jobs updated, follow me on Twitter and Facebook, or email me. Buy Aaron Brown's book – until someone of you buys the book and I can confirm it on Amazon, I will keep pushing the message. There is nowhere to hide, no excuses will suffice. To the right a week-old video on Greece by Stratfor,

Markets Live – alphaville FT

Debt crisis: live – The Telegraph

Eurozone crisis: live blog – FT

Debt crisis Live Blog – The Source / WSJ

7th Oct - Guest Post by Macronomics

Again an excellent credit market review by Macronomics.

I would like to thank Kari "The Street", Pauli "The Spread", "Wolfgod" and Samuel "The Athlete's Foot" for their feedback, much appreciated. Special thanks for guest posts to Macronomics and The Trader and for linking to this site to Simoleon Sense.

I updated the Steve Jobs-post. Leave a comment, follow me on Twitter and Facebook, or email me. Buy Aaron Brown's book – and buy another as a gift to me. Regular Linkfest to follow, stay Fonzarelli out there.Then to today's Guest Post:

Thursday, October 6

6th Oct Late - Oh BoE, God save the QE

|

| CLICK ME TO BEGIN |

“A historic press conference is about to unfold, in which the current ECB president, in a state of complete denial about the imminent implosion of his continent, will mumble for 45 minutes one last time and attempt to preserve his "legacy" after which he will hand over the "printer" briefcase and secret codes to none other than Goldman's Mario Draghi. And Goldman, as is well known to Zero Hedge readers, is certainly not nearly as shy as ole' Tricky to print when needed. Expect some vague promises of more liquidity, possibly the reopening of a 1 or 2 year repo line in which the ECB will accept even more used banana peels and sexual prophylactics in exchange for euros, and an overall deflationary bias. It doesn't matter. It is too late. More importantly, today's "shot rules" are a shot of Jager every time the words "price stabeeleetee" are uttered.” – Zero Hedge

6th Oct Early: Stress @ Home

Summary: ECB coming up. Notice the do-it-yourself stress test calculator to the right. Shorter linkfest today, if something special happens, I’ll post another around the U.S. close. Previously I posted a separate linkfest on Steve Jobs and on ECB/Trichet.

If you want a view, deep search or quant work on some topic for free, contact me and spread the word, I'm trying to gain street cred here. Feedback is always appreciated, leave a comment, follow me on Twitter and Facebook, or email me. Buy Aaron Brown's book – and buy another as a gift to me.

Steve Jobs

|

| Empty. |

Preorder the coming biography Steve Jobs by Walter Isaacson

Live coverage - Reuters

Steve Jobs has died – boingboing

Steve Jobs: More than a turnaround artist – L.A. Times

We All Called Him Steve … – Wired

Steven Levy: Steve Jobs, 1955 – 2011 – Wired

(Wired’s home page has a special tribute for the time being)

Apple 'visionary' Steve Jobs dies aged 56 – BBC

Jobs, Who Built Most Valuable Technology Company, Dies at 56 – Businessweek

Subscribe to:

Comments (Atom)