|

| Showing every transaction |

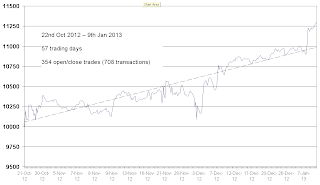

Papertrading

22nd Oct 2012 – 9th Jan 2013

57 market days

354 trades (=708 transactions), mostly EURUSD and USDJPY

|

| Daily performance |

Previously on MoreLiver’s:

Roundups and

Commentary

News – Between The Hedges

Markets – Between The Hedges

Recap – Global

Macro Trading

The Closer – alphaville

/ FT

Tomorrow’s Tape: Wells Fargo Earnings, Trade Deficit –

WSJ

US: Forget 'Rotation'; 2013 Is The Great 'Risk'

Recoupling So Far – ZH

Reference

Debt crisis

live – The

Telegraph

The Euro

Crisis Blog – WSJ

FX Options

Analytics – Saxo

Bank

European

10yr Yields and Spreads – MTS indices

Economic

Calendar – Forexpros

EUROPE

Dijsselbloem to replace Juncker as Eurogroup

chief – euobserver

Outgoing

Eurogroup chair Jean-Claude Juncker has hinted that his replacement will be

Dutch finance minister Jeroen Dijsselbloem.

Germany wants a second attempt to reach an

EU budget deal on 7-8 February, but EU Council chief Van Rompuy is unsure.

PIIGS

Beginner’s guide to Italy’s general election

2013 – The

World / FT

ECB

MEETING

Introductory statement to the press conference – ECB

Draghi Hails ‘Positive Contagion’ as Euro

Markets Stabilize –

BB

Draghi said

the euro-area economy will slowly return to health in 2013 as the region’s bond

markets stabilize after three years of turmoil.

ECB's sees recovery in late 2013 – Reuters

The euro

zone will recover later in 2013 and there are already signs of stabilisation,

the ECB said after it held interest rates at a record low.

Recap: ECB Meeting – The

Euro Crisis / WSJ

Draghi Does Not Hint at Change in ECB Policy – Marc

to Market

Draghi keeps the door wide open for more

easing, but it will require more weakness – Nordea

Mario's waiting game – Free

exchange / The Economist

Existential

worries about the euro area may have gone away for the time being, removing the

darkest cloud of all. But there are good reasons for doubting whether things

will turn out as well as Mr Draghi thinks.

ECB meeting - no more rate cuts – Danske

Bank (pdf)

Overall, we

are slightly more optimistic on the growth outlook than the ECB staff

projection and we believe it is likely that the rate discussion will fade as

the euro area returns to positive growth in H1.

Eurozone on its way back to growth, Draghi says – euobserver

ECB chief

Mario Draghi has spoken of "positive contagion" in the eurozone - a

rare moment of optimism since the crisis started four years ago.

ECB Afterthoughts: Dull – TradingFloor

ECB left

rates unchanged, signaled no immediate rate cut or introduction of new

unconventional measures, and as everyone else prints and targets thresholds,

the euro strengthened.

UNITED STATES

The Debt Limit: Not a Credible Way to Control

Spending – EconoMonitor

The debt

limit is expected to become binding (i.e., extraordinary measures will become

exhausted) between February 15 and March 1. The limit needs to be raised by

$1.1 trillion to get through 2013 and by $2.1 trillion by the end of 2014

Right now

it appears the drag from austerity will probably offset the pickup in the

private sector - and we can expect another year of sluggish growth in 2013 probably

in the 2% range again.

OTHER

EMEA Weekly – Danske

Bank (pdf)

Currency Bores - What Policymakers Really Mean

When They Talk About FX – ZH

Steven

Englander of Citi: It is hard to find a policymaker who hasn’t actively tried

to talk his currency down.

Global Alpha Weekly – Nordea

(pdf)

Monetary

policy: Rather late than sorry * Bank of Japan – Hawks need not apply