Plenty of stuff - some more 'econ' stuff relating to Europe is included here instead of the previous Weekender: Euro Crisis-post.

Plenty of stuff - some more 'econ' stuff relating to Europe is included here instead of the previous Weekender: Euro Crisis-post.Saturday, March 31

31st Mar - Weekender: Trading & Economics

Plenty of stuff - some more 'econ' stuff relating to Europe is included here instead of the previous Weekender: Euro Crisis-post.

Plenty of stuff - some more 'econ' stuff relating to Europe is included here instead of the previous Weekender: Euro Crisis-post.31st Mar - Weekender: Euro Crisis

Weekend, and more European crisis porn. Hardly surprising that the firewall was shot down even before it was agreed upon. The real news was probably Bundesbank's announcement not to accept bank bonds guaranteed by countries on bailout. This is probably just signaling, as the national central banks can and will still accept them. So what is BuBa trying to do? The central bank of Portugal can still accept any manufactured collateral it wants and still get funding from the ECB. Meanwhile, Spain, Portugal and Greece look terrible.

To kick off the Saturday evening, here's the Energy 52's Café Del Mar, a classic trance track from 1993. Stay sharp and remember to worship the Techno Viking (wiki, youtube, parody)

To kick off the Saturday evening, here's the Energy 52's Café Del Mar, a classic trance track from 1993. Stay sharp and remember to worship the Techno Viking (wiki, youtube, parody)

31st Mar - Weekly Support

Here are the links to weekly summaries and previews of the next week. This post will be updated as new material comes in. For good articles, see Best of The Week. Usual Weekender and Economics & Trading-posts coming up later. I’m on Twitter, Facebook, email, paper.li. Tell me what you want and I’ll do it.

Friday, March 30

31st Mar - Credit Guest: Spanish Denial

Here is the latest guest post by Macronomics. It gives the same message as everyone else - Spain is quite doomed, but the eurocrats still put out a brave face publicly. The usual Weekly Support, Weekender and a Trading & Economics special coming up during the weekend. Enjoy.

Here is the latest guest post by Macronomics. It gives the same message as everyone else - Spain is quite doomed, but the eurocrats still put out a brave face publicly. The usual Weekly Support, Weekender and a Trading & Economics special coming up during the weekend. Enjoy.30th Mar - Best of The Week

Here are the best articles from my ending week’s posts. The story is completely clear – Spain and Portugal are seen as the next targets for the Troika’s commandos. When the agreement on the EFSF/ESM ‘Death Star’ is finalized during the weekend, it will be gloves off. Most of this will be done behind the curtains for now. I think the eurocrats understand very well the Spain’s hopelessness, but they don’t want to draw the attention of media just yet – the public must be kept in the dark until the French and German elections are over.

30th Mar - US Opening Briefings

Here are the briefings for the US opening. For articles, see yesterday's Do The Hustle and Roll over and play dead. Come back during the weekend to check my regular postings.

Thursday, March 29

29th Mar - Do The Hustle

Week's main event is approaching: Eurogroup meeting to agree on the rescue vehicle details. A 750bn widget is already priced in. The European bond markets have looked ugly going into the meeting - no signs of buying into the news. The markets are awash with news that the US earnings cycle is peaking, while positive economic surprises have already peaked, and soon slowly turning negative. Time for correction? I don't know.

29th Mar - Roll over and play dead

Again choice articles on eurocrisis. Commentary on Europe clearly negative, Petet Tchir’s piece Austerity – Mais, non is a must-read.

Again choice articles on eurocrisis. Commentary on Europe clearly negative, Petet Tchir’s piece Austerity – Mais, non is a must-read. 29th Mar - Morning Briefings

Just the morning briefings. For some really nice articles (Spain, Japan, usual eurocrisis), see last night's The Count Room.

Wednesday, March 28

28th Mar - The Count Room

A lot of articles, interesting that Spain is getting a lot of bad press. Also Japan’s crash is either seen as imminent or a possibility – but no-one seems to deny that it is looking shaky (me on Spain).

All eyes are on the weekend’s eurocrat techno rave party, where they will supposedly agree on a larger rescue vehicle by combining and/or running simultaneously the EFSF and ESM. Again, the commentary is highly skeptical that it will work for long. Goldman is already thinking ahead and sees all the trash buried in a special vehicle. This would circumvent any democratic inconveniences and clean up the balance sheets of the operators.

As I did not post during the day (even MoreLiver has to occasionally work a bit), I've included the US Open regular links as well. If you want something, you know where to find me: let's meet outside the count room.

28th Mar - "Everybody Can Change"

Good morning! Here are the morning briefings and links to couple of interesting articles I missed in last night’s Intervene, Unforeseen?. Next update after the US close - no lunch reviews today! Next weekend I will write my thoughts and lessons learned on intervention, plus an angry rant aimed at the eurocrats – if I can change and you can change, everybody can change.

Tuesday, March 27

27th Mar - Intervene, Unforeseen?

|

| Consensus expectations higher, reality lower |

27th Mar - Krugman kicks Katainen, Euromaster's "Plan"

Here are

the lunchtime regular briefing links plus some interesting articles I’ve

cherry-picked. The first article (luckily short one) in Euro Crisis is worth reading: authors are Marco Buti (Director

General of EMU at the Directorate-General for Economic and Financial Affairs)

and Pier Carlo Padoan (OECD Deputy Secretary-General and Chief Economist).

Their suggested solution is of course orthodox (no euro break-up) and possibly not workable, but the one that will be implemented, as Marco B. is what Krugman would call a "Very Serious Person". On that note, Krugman beats Finland's prime minister senseless and introduces a new, Orwellian word growsterity.

Their suggested solution is of course orthodox (no euro break-up) and possibly not workable, but the one that will be implemented, as Marco B. is what Krugman would call a "Very Serious Person". On that note, Krugman beats Finland's prime minister senseless and introduces a new, Orwellian word growsterity.

27th Mar - Morning Briefings

Here are the morning briefings, for articles and other's views see last night's Reading Bernanke. Keep in touch with me through Twitter, Facebook, email, paper.li. Next stops the lunch time update and an evening post, stay (trigger-)happy!

Here are the morning briefings, for articles and other's views see last night's Reading Bernanke. Keep in touch with me through Twitter, Facebook, email, paper.li. Next stops the lunch time update and an evening post, stay (trigger-)happy!26th Mar - Reading Bernanke

Sorry about the late update – I watched the Quantum of Solace. Not recommended.

Monday, March 26

26th Mar - Death Star vs. Bank Runs

After Saturday's post, plenty of interesting articles. I recommend taking a deep look at three key drivers for now:

- 'Death Star' announcement game - or bailing out the Spanish banksters with taxpayer money

- Shadow bank runs: how, what, when and who.

- The core meltdown: the only remaining country with an effective AAA is now Germany - and this means the game is up soon.

The other issues like Greece (everyone knows they're bust, all the bonds will be marked to zero, will be kicked out of the euro etc), austerity hurting growth, major real policy summits in couple of month's time to finally decide what to do with the crisis, are not surprises and maybe or maybe not are priced in. But the above three points will provide the major surprises and wealth transfers

.

Then to the articles, but just a quick reminder of past weekend's postings:

26th Mar - Morning Briefings

Good morning! Here are the morning briefings, the Saxo Bank's FX option vol daily is back in the regular links. Next stop will be the lunch time update - I have some views to write, but not sure if I can find the time for it. Here’s what I’ve published during the weekend:

Good morning! Here are the morning briefings, the Saxo Bank's FX option vol daily is back in the regular links. Next stop will be the lunch time update - I have some views to write, but not sure if I can find the time for it. Here’s what I’ve published during the weekend:Sunday, March 25

25th Mar - Weekender: Trading

Here are some trading- and markets-related articles for the thus inclined. Previously posted on this weekend:

Here are some trading- and markets-related articles for the thus inclined. Previously posted on this weekend:Best of The Week: from my this week's posts

Weekly Support: weekly reviews and previews

Crisis & Views: crisis and asset class views

Economics: articles and journal papers from recent months

Saturday, March 24

25th Mar - Weekender: Economics

Here are some economics articles for the thus inclined. Previously posted on this weekend:

Keep in touch with me through Twitter, Facebook, email, paper.li.

Best of The Week: from my this week's posts

Weekly Support: weekly reviews and previews

Crisis & Views: crisis and asset class views

Keep in touch with me through Twitter, Facebook, email, paper.li.

24th Mar - Credit Guest: The Spread Also Rises

A new guest post from the always excellent Macronomics. It takes a deeper look at Spain and the picture isn't pretty. Have fun with it, and remember to sell temporary strength provided by ECB, courtesy of the European tax payers.

24th Mar - Weekender: Crisis & Views

Friday saw a quick rise in periphery’s bond prices – and it is probable the ECB was the customer. They probably wanted to end the week on a positive note and make it look like a positive reaction to the preliminary agreements on the enlargement of the European rescue vehicles. Again the commentary is hugely negative, with more unsolved (and unsolvable problems) than anyone can address.

Given the situation, the rhetoric coming out from the mouths of Draghi, Van Rompuy and Rehn is ridiculous. I had a word last week with an unnamed economic adviser and we wondered do they put something to the eurocrats' drinking water. Or what do you make of this:

Friday, March 23

23rd Mar - Weekly Support

Here are the links to weekly summaries and previews of the next week. This post will be updated as new material comes in. For good articles, see Best of The Week. A Weekender- reading package coming up later. I’m on Twitter, Facebook, email, paper.li. Tell me what you want and I’ll do it.

23rd Mar - Best of The Week

Here are the best links from my ending week's posts, in case you missed them. The top themses were the higher bond yields in US, in Europe the worsening outlook for Spain and Portugal and the diminishing sparkle of Merkozy and ECB's recent actions.

The Weekly Support and Weekender posts are coming up next. I’m on Twitter, Facebook, email, paper.li.

23rd Mar - Morning Briefings

Good morning! Here are the morning briefs, for the reads and my thoughts see last night’s Spain is Game Over. I’m on Twitter, Facebook, email, paper.li.

Thursday, March 22

22nd Mar - Spain is Game Over

|

| The Spanish Government 10-year bond yield |

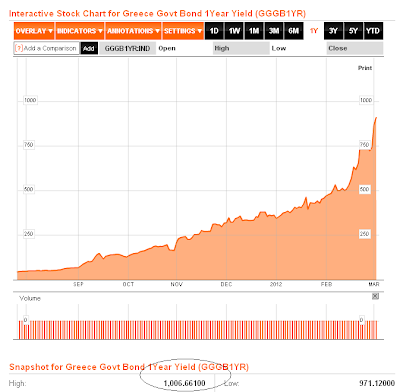

The Spanish 10-year bond yields and the 5-year CDS prices continued their march upwards. Here's how I see this: last summer's great EU Summit that was supposed to solve everything did not manage to agree on anything, so ECB was forced to start supporting the PIIGS bonds in the secondary markets (so-called SMP). The CDS prices kept on rising, effectively decoupling from the manipulated bond market, and kept rising until the two LTRO's were announced (see the charts, click to enlarge).

22nd Mar - Morning Briefings

Good morning! Here are the morning briefs, for the reads and my thoughts see last night’s Buiter Butchers. I’m on Twitter, Facebook, email, paper.li. Ask me anything – I’m eager to please.

-MoreLiver

Wednesday, March 21

21st Mar - Buiter Butchers

|

| Austerity is Growth! War is Peace (from Krugman) |

The LTRO-induced holiday from the Euro Crisis is still going on, but the recent upward march of the Spanish 10-year bond yield is making many nervous – today the yield was 5.4%, and in 2012 the range has been 5.75%-4.83%. Even though the yield is still within this year’s range, I find it worrisome that the move has been determined.

21st Mar - Yields and Growth, We All Hope

|

| "You are here" |

Good morning America! Evening post coming up later, for now enjoy these somewhat off-topic articles. Eurocrisis is on a short holiday but the sequels (Greece III, Portugal II) and whole new twists (Spain and Germany's reluctance) are coming soon to theaters near you. I’m on Twitter, Facebook, email, paper.li. Ask me anything – I’m eager to please.

21st Mar - Morning Briefings

Good morning! Here are the morning briefs, for the reads see last night’s Banks captured Europe . I’m on Twitter, Facebook, email, paper.li. Ask me anything – I’m eager to please.

Tuesday, March 20

20th Mar - Banks captured Europe

None of the articles today are critical must-reads, but most of them have interesting long-term points and background thinking - enjoy!

20th Mar - Lunch: Broken Europe

Lunch update: PIMCO on Eurocrisis transmission channels, UK's creative accounting

20th Mar - Schwager: Hedge Fund Wizards

Jack D. Schwager, the author of the classic Market Wizards-books, is coming out with a new one: Hedge Fund Market Wizards – Amazon, other books by Schwager here. The book is out in May, preorder now.

20th Mar - Morning Briefings

Good morning! Here are the morning briefs, for the reads and views see last night’s Crisis Halt, S&P Hulk . I’m on Twitter, Facebook, email, paper.li. Ask me anything – I’m eager to please.

To the links:

Monday, March 19

19th Mar - Crisis Halt, S&P Hulk

|

| Europe is almost as bad as in Great Depression |

The Greek CDS auction came and went and nobody really seemed to think twice about it. And at least one chartist has noticed there is a Hulkamania-pattern in S&P 500. For my current views, see this. And now:

19th Mar - Asset views, waiting news

Lunchtime update: Greek CDS auction under way (Bloomberg, MarkIt). EFSF held a conference call with investors, planning to sell 10-20 year bonds to finance the Greek mess – until now, the rescue vehicle has only sold short maturity instruments. Some very nice articles: my favorite Simon Johnson blasts the Fed’s stress tests and Grant Williams’ latest newsletter is again good stuff. For my views see the weekend postings.

19th Mar - Morning Briefings

Good morning! Here’s what you missed during the weekend: I posted two Weekender posts: Economics & Off-Topic and Crisis & Views – the latter had plenty of my own discussion on the markets. A credit guest post by Macronomics and the weekly reviews in Weekly Support will surely get you sorted. For even more readings see Best of The Week and Goldman Sachs Letter - The Collection.

I’m on Twitter, Facebook, email, paper.li. Ask me anything – I’m eager to please. And now to the Monday morning briefings:

Sunday, March 18

18th Mar – Weekender: Economics & Off-Topic

For market views and crisis reads, see Weekender: Crisis & Views and for other people's market-induced hallucinations, see Weekly Support. But for now, Economics and Off-Topics in MoreLiver's Sunday play school. More off-topics available in Goldman Sachs Letter - The Collection.

18th Mar - Weekender: Crisis & Views

Greek CDS auction kicks the week in, and as FT’s article points out, the actual amount to be settled remains a question mark. The most important driver in the coming months is the growing rift between Merkel and Sarkozy – to win the elections, Sarkozy tries to adopt themes from both the far left and far right. It is obvious that France is unwilling, perhaps even unable to commit to a pro-European, pro-growth and pro-fiscally balanced policies. To effectively handle the coming fiscal target misses from Spain and the restructuring of Portugal’s debt requires a lot of unity and determination from the “Merkozy” – not to mention coercing the other surplus countries like Finland and Netherlands to play ball. If Paris and Berlin cannot agree on a game plan, the markets will call a time out and the European dream will lie in tatters (more in Euro Crisis: General links)

Saturday, March 17

17th Mar - Weekly Support

Here are the links to weekly summaries and previews of the next week. This post will be updated as new material comes in. For Goldman stuff, see Goldman Sachs Letter - The Collection and for the must-read articles Best of the Week. A Weekender- reading package coming up later. I’m on Twitter, Facebook, email, paper.li. Ask me anything – I’m eager to please.

17th Mar - Best of The Week

Here are the best links from my ending week's posts, in case you missed them. The Weekly Support and Weekender posts are coming up next.

EURO CRISIS: GENERAL

There Will Be Contagion – John Mauldin / The Big Picture

Sarkozy: Problem Solved, Or… Germany to Sarkozy: It’s Not Over · The ISDA Steps Up · No Winners in Ugly Greek Debt Deal, Only Lessons · And By the Way, Close Your Borders ·

The Next Greek Tragedy · Orlando, Stockholm, Paris, and Staying Young

Friday, March 16

Thursday, March 15

15th Mar - Why MoreLiver's Is What It Is

|

| They sold his bonds - but they forgot one thing... |

The eventual Merkozy break-up and France's bleak future in the post-europalyctic world are some rising topics. Bond- and JPY show will probably take a pause, as eurocrisis and QE are making a sort of a comeback. Two good "off-topic" articles today and some nice asset class views.

Any feedback would be much appreciated. I know, give us more of your own views, I don't have time to go through all this material, blah blah. Guess what: all the material I post is selected based on my views - even the regular links - the news recaps by Between The Hedges are the best I've seen. I go through a lot more material every day. I select the ones that I believe are important to understand the current (and the next!) market drivers.

15th Mar - Morning Briefings

Good morning! I created a new Goldman post that I intend to update continuously. For views and reads, see my last night's main post. Now to the morning regulars:

Wednesday, March 14

Goldman Sachs Letter - The Collection

14-MAR

Why I Am Leaving Goldman Sachs – NYT

Executive director and head of the firm’s United States equity derivatives business in Europe, the Middle East and Africa: TODAY is my last day at Goldman Sachs. After almost 12 years at the firm — first as a summer intern while at Stanford, then in New York for 10 years, and now in London — I believe I have worked here long enough to understand the trajectory of its culture, its people and its identity. And I can honestly say that the environment now is as toxic and destructive as I have ever seen it.

14th Mar - Goldman and bond reversal

|

| Spain & Italy, 400bn TARGET debt |

Very interesting day. We probably saw an important reversal in bond markets, which I duly noted already last night. Are the bond bulls dead? Probably, as the alternative is Japanification. Meanwhile, The “Goldman Letter” is widely commented by everyone, and this will probably change the way how customers do business with investment banks – and how the investment banks conduct their business. See – it was not about the housing crisis, the crimes, the lying, the billion-dollar fines. All it took was one confession of moral wrong, and everyone is all over the banks. After the PR disaster is over, Goldman and few other banks will look a lot different.

14th Mar - Goldman's PR disaster & 100y bonds

|

| Time to sell bonds? |

Lunch time update: Goldman has a PR disaster - more in the links below. Check last evening's post for views. You can follow MoreLiver via Twitter, Facebook, email and paper.li

News And Market Re-Cap – RanSquawk / ZH

Today in the euro zone – MacroScope / Reuters

The Lunch Wrap – alphaville / FT

EZ Crisis Daily Press Summary – Open Europe

EZ Crisis Daily Press Summary – Open Europe

14th Mar - Morning Briefs

Here are the morning reports. For my views and articles, see last night's US yields break higher

Tuesday, March 13

13th Mar - US yields break higher

|

| Bond futures breaking lower, with plenty of room to go |

Monday, March 12

12th Mar - When good looks matter most

BIS report from yesterday states the increased capital requirements for the European banks were a stupid idea. The eurocrats wanted to increase the confidence, which they perhaps managed to do - but simultaneously they decreased the financial activities of the banks. The idea was to save the economy - not the looks! Also LTRO gets a word in today's links.

BIS report from yesterday states the increased capital requirements for the European banks were a stupid idea. The eurocrats wanted to increase the confidence, which they perhaps managed to do - but simultaneously they decreased the financial activities of the banks. The idea was to save the economy - not the looks! Also LTRO gets a word in today's links.Sarkozy is trying his best to look more socialist and more right-wing than either of his competitors. How sad. More Europe is probably the answer even for the little man's issues. I just realized that 'Merkozy':

12th Mar - China, BIS report and Hmmm..

Here is the lunchtime roundup of the blogosphere. Lots on China, and several good ones on Europe - don't miss the two highlighted links under Other. Ireland and Portugal next in the bailouts & restructurings queue. For my current views read this, this and this.

Here is the lunchtime roundup of the blogosphere. Lots on China, and several good ones on Europe - don't miss the two highlighted links under Other. Ireland and Portugal next in the bailouts & restructurings queue. For my current views read this, this and this.Have a good one, to the links:

12th Mar - Morning briefs

Here are the morning briefs to get you started. For a longer perspective see the earlier Weekly Support post and for my own views read this, this and this.

For those just returning after the weekend, here’s what you have missed:

Sunday, March 11

11th Mar - Weekender: ECB getting squeezed

|

| The European ratings look...kind of sad? |

Good weekend everyone! No Greek news here, I push all of them to Greek Deal Roundup. I have published several linkfests during the weekend, check them if you are new here.For my views, read this, this and this. I would love to get some feedback and requests: I am on Twitter, Facebook, email and paper.li

EURO CRISIS: GENERAL

Finns Party Soini: Make The Greek Collateral Deal Public – Dow Jones

Finland demanded collateral to participate in Greek rescue, government declared collateral deal classified, Finns Party wants documents made public

There Will Be Contagion – John Mauldin / The Big Picture

Sarkozy: Problem Solved, Or… Germany to Sarkozy: It’s Not Over · The ISDA Steps Up · No Winners in Ugly Greek Debt Deal, Only Lessons · And By the Way, Close Your Borders ·

The Next Greek Tragedy · Orlando, Stockholm, Paris, and Staying Young

11th Mar - Bridgewater & Trading

Some interesting articles on trading and the now "officially" greatest hedge fund of all time - Bridgewater.

Saturday, March 10

10th Mar - Weekly Support

Here are the links to weekly summaries and previews of the next week. This post will be updated as new material comes in. For Greek PSI stuff see my continuously updated Greek Deal Roundup and for the must-read articles Best of the Week. I will post a Weekender reading package later. I’m on Twitter, Facebook, email, paper.li. Ask me anything – I’m eager to please.

Here are the links to weekly summaries and previews of the next week. This post will be updated as new material comes in. For Greek PSI stuff see my continuously updated Greek Deal Roundup and for the must-read articles Best of the Week. I will post a Weekender reading package later. I’m on Twitter, Facebook, email, paper.li. Ask me anything – I’m eager to please.Friday, March 9

9th Mar - Credit Guest: Ecce Creditor

MoreLiver's regular guest Martin from Macronomics is back with his weekly credit markets update, this time taking a look at Europe after the Greek PSI and the recent LTRO2.

Take it away, Martin!

Take it away, Martin!

9th Mar - Best of the Week

Here are my ending week's best links, collected to one post. There are three big issues remaining in the euro crisis: living with LTRO, TARGET2 imbalances and the sorry state of the PIIGS. These have to be solved, euro or no euro. Tackling the recession and the current account imbalances inside the EZ are advanced topics - maybe there is no solution, except at least a partial introduction of national currencies.

Here are my ending week's best links, collected to one post. There are three big issues remaining in the euro crisis: living with LTRO, TARGET2 imbalances and the sorry state of the PIIGS. These have to be solved, euro or no euro. Tackling the recession and the current account imbalances inside the EZ are advanced topics - maybe there is no solution, except at least a partial introduction of national currencies. 9th Mar - Greek Deal Roundup

So, the Greek deal is "done" - here's a roundup of what the news agencies and blogs have on the topic. I will update this post as the story develops, latest updates at the bottom of the post. You might want to refer to my Greek Exit Collection from 12-Feb in case of a hard default. I hold on to my views that this was a case of buy the rumor & sell the news. For my views, read this (from last night), this and this.

Thursday, March 8

8th Mar - PSI done

|

| Money supply fails to rise. Source. |

The Greek PSI participation rate is supposedly high enough for a voluntary bond swap, more on that tomorrow. What I have been saying for several weeks now: the focus is moving ahead of Greece. Last two weeks, it has been Portugal and Spain, recently Japan and now the whole global imbalanced system is discussed.

8th Mar - Waiting for Greek bondage

A lunchtime roundup of the blogosphere. BoE did nothing, ECB still to come but nothing expected. Risk-on day as the Greek deal looks more probable. What do you think will happen and the deal is done, and the focus shifts to Portugal, Spain and Ireland - and the fact that Greek will still be after the second bailout on an unsustainable path? I stick to my earlier views here and here.

8th Mar - Morning Briefs

|

| Old - but concentrated. Telegraph |

Wednesday, March 7

7th Mar - QE & PSI speed race

Huge evening post, but interesting developments. The yesterday’s bear was killed in mid-flight by rumors of “sterilized QE” in U.S. After LTRO2 and Japan’s latest policy shift, U.S. was indeed kind of falling behind in the money printing race. This competitive “who prints most”-stuff would be getting a bit comical, if the situation were not grave. The macro picture is bad and positive surprises are not around the corner, so I stick to my earlier views that we will have weeks or even more of risk-off.

7th Mar - On China and Eurotrouble

|

| EURUSD and relative sizes of CB balance sheets, from ZH |

Here is today’s first blogosphere roundup. For Euro crisis ideas, please also consider the first article posted under Other.

EURO CRISIS: GENERAL

Reflections on the crisis, thus far… – alphaville / FT

Deutsche Bank sees very limited room for fiscal easing, thus more monetary easing is the only policy choice

7th Mar - Morning Briefs

Here are the morning briefs, plus central bank meeting previews and a Greek debt swap guide from the Danske Bank. For a good summary of articles, Tue recap and my views, please refer to last night’s post Risk...OFF!. I am on Twitter, Facebook, email and paper.li

Tuesday, March 6

6th Mar - Risk...OFF!

Greek PSI getting most of the attention in this risk-off day: small holdouts threaten the required participation rate for the bond swap, while Greece announces any holdouts will not be paid. Great, a staring contest to end the week. EURUSD doing what I pretty much expected it to do - coming down after the LTRO. I believe several pain points are hitting the market simultaneously: while LTRO brought liquidity, it also made risky assets in Europe slightly more risky – there simply is not any follow-through demand for them - especially since there are no pre-announced LTRO follow-ups.

6th Mar - Germany losing friends

A lunchtime roundup of the blogosphere. Leaving the euro discussed openly in Holland, only three AAA's left, Spain breaking austerity promises. There goes the fiscal pact - now up to Germany to compromise its stance - or end up picking up the bill from TARGET2 receivables.

6th Mar - Morning Briefs

Usual linkfest in couple of hours, for now, just the morning briefings. You might also want to check last night's Views that had plenty of articles and the daily wraps.

Monday, March 5

5th Mar - Guest "Kessu" (in Finnish)

For the Finnish speakers - risks arising from the TARGET2-imbalances.

5th Mar - Views

|

| Markets are too optimistic. |

The writings against the divinity of the LTRO keep coming out. While majority of commentators accept that it was necessary to save the banks, ECB's iron hand in subordinating private debt holders has set a nasty precedent. For the moment stock markets are ignoring the discontent of the bond markets.

Spain and especially Portugal look really bad at the moment, and both of them are going to have a friendly chat with the Troika. Given Spain's size, I think that's it for any remaining solidarity. The figures what the Portuguese banks did with the LTRO are terrible. The Minsky moment is approaching, and the true resolve of the eurocrats will again be tested.

5th Mar - From LTRO to TARGET2

Good morning! LTRO’s shine has grown darker, as market participants are beginning to understand that it is not a solution, instead it is just another place to store and hide the eventual losses arising from a decade of current account imbalances and investments into risky assets. Discussion has clearly moved to TARGET2-system – Buiter’s piece from last week is probably the best article on the topic (pdf here).

I would love to get some feedback and requests: I am on Twitter, Facebook, email and paper.li I was busy during the weekend. If you had a life during the weekend and were not following me, here’s what you missed:

Saturday, March 3

3rd Mar - Weekender: CDS gone Greek, Post LTRO-tic

This weekend's reading package is stuffed with some very good general articles on Europe, and a large dedicated section on the CDS markets in light of the Greeky developments (see also this and this). Hope you enjoy, I would love to get some feedback and requests: I am on Twitter, Facebook, email and paper.li

Subscribe to:

Comments (Atom)