|

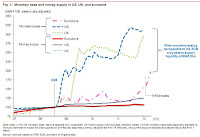

| Money supply fails to rise. Source. |

The Greek PSI participation rate is supposedly high enough for a voluntary bond swap, more on that tomorrow. What I have been saying for several weeks now: the focus is moving ahead of Greece. Last two weeks, it has been Portugal and Spain, recently Japan and now the whole global imbalanced system is discussed.

There will be plenty of stuff to trade on during the next couple of months. EURUSD will provide ample opportunities, as the QE programs of the two currency areas are not synchronized. JPY is another good candidate. They want the yen weak, but not too weak, Sober Look is again spot-on in their analysis (sorry about the pun). I love these kinds of markets, as they become almost spread trades in themselves: bouncing around two extremes and eventually mean-reverting. Much more easier than trying to outsmart the market and pick turning points in trends.

Playing the European sovereign game is more difficult. We’ve already seen how even a CDS position can be destroyed by the interference from politicians. Again I think spreading will make sense: financials against index and proxy trading are two obvious alternatives.

In proxy trading one does not touch the actual target you have your view on – you instead take the position in a causally correlated market. For example, going short Portugal is difficult and prone to interference from the eurocrats, so instead go short the ones who will have to pick up the bill and go long the ones that are to be bailed out. You can probably come up with other and more elaborate set-ups.

- MoreLiver

News – Between The Hedges

Euro Crisis Press Summary – Open Europe

Markets – Between The Hedges

Recap – Global Macro Trading

Debt crisis: live – The Telegraph

Europe Crisis Tracker – WSJ

EURO CRISIS: GENERAL

European Banks Face Rising Refinancing Costs – DealBook / NYT

Now, attention is turning to the mountain of debt firms will have to refinance over the next two years.

There’s a sense of relief among European policymakers that the worst of the euro zone’s crisis appears to have passed…So where will growth come from?…with Germany responsible for almost 40 percent of the euro zone’s exports, a wider tide of prosperity across the currency area looks unlikely.

Podcasts:

Deutsche Bank’s Ruksin Says Inflation Is a Concern – BB (mp3)

BofA’s Levy Sees No Need for More Federal Reserve QE – BB (mp3)

Schroders’s Brown Says Greek Debt Issue Not Solved – BB (mp3)

EURO CRISIS: ECB, LTRO, TARGET

Since Draghi's second savior LTRO, European markets have been flip-flopping gradually lower. These four charts do not seem to suggest a market that is confident about tail-risk containment, sovereign firewalls, or an orderly restructuring by Greece.

Ex-ECB's Stark Says ECB's Balance Sheet "Gigantic", Collateral Quality "Shocking" – ZHFormer ECB executive board member Juergen Stark adds: the structure of the balance sheet is a cause for concern because increasingly short-term debt claims are being replaced by long-term ones and this will make it more difficult for the bank to reverse its loose monetary policy.

EURO CRISIS: ECB MEETING

Introductory statement to the press conference – ECB

Draghi Lays Groundwork for ECB Exit as Inflation Takes Spotlight – BB

FX Comment: ECB Decision – BNY Mellon

ECB meeting: Draghi doing the victory dance – Danske (pdf)

European central bank decisions: Taking a breather – Free exchange / The Economist

But the tensions with the Bundesbank are a reminder that he will face similar constraints to the ones that hemmed in his predecessor, Jean-Claude Trichet. The ECB under Mr Draghi may have signalled that it can and will “shock and awe”—but only in the nick of time.

GLOBAL CRISIS

Taming the liquidity tide – Economist’s Forum / FT

The task force echoes a growing consensus that such acts are not protectionism, but correctionism. According to the new welfare economics of capital controls, unstable capital flows to emerging markets can be viewed as negative externalities on recipient countries.

Global imbalances: Gross mismanagement – Free exchange / The Economist

A focus on the net figures—the extent to which assets offset liabilities—ignores that different people might be holding the liabilities and the assets. The government can nonetheless step in and use the one to pay off the other, but it isn't going to do that unless a crisis is already underway.

Sovereign debt: Safe keeping – Free exchange / The Economist

There is a critical lesson in this for American policy makers: you monkey with an asset’s reputation for safety at your peril…long after Europe’s politicians repudiated their earlier demand that investors risk losses on all sovereign debt, Italy and Spain are still forced to borrow at significantly higher costs than Germany. The feeling of safety, once lost, is not easily recaptured.

Chart of the Day: Monetary Transmission Mechanisms – Credit Writedowns

This balance sheet recession is not really about liquidity traps and and the zero bound for interest rates. It’s about overindebted private sectors that have limited increased demand for credit. If and when the demand for credit increases, so too will the money supply

OTHER

Charlie Munger on the psychology of human misjudgment – RBCPA (pdf)

20-page speech at Harvard University from June 1995

EMEA Weekly, Week 11 – Danske Bank (pdf)

Stuck between the two alternatives of either higher energy costs (lower margins) or weaker exports, Japan is truly in a tough spot.

Quanto CDS, the widow-maker – alphaville / FT

The difference between the CDS quotes in dollars and euros is the quanto spread, and that’s the thing that one could trade as a product in its own right. Illiquid, one-sided dealer books, accurate conceptualization of scenarios and risk management difficult.