|

| Plenty of downside left in the German stock index - at least to the lower end of the trading range. |

|

| US positive surprise index has turned down from high levels (expect negative surprises in the near future), while Euro zone negative surprises are largely behind us now. |

|

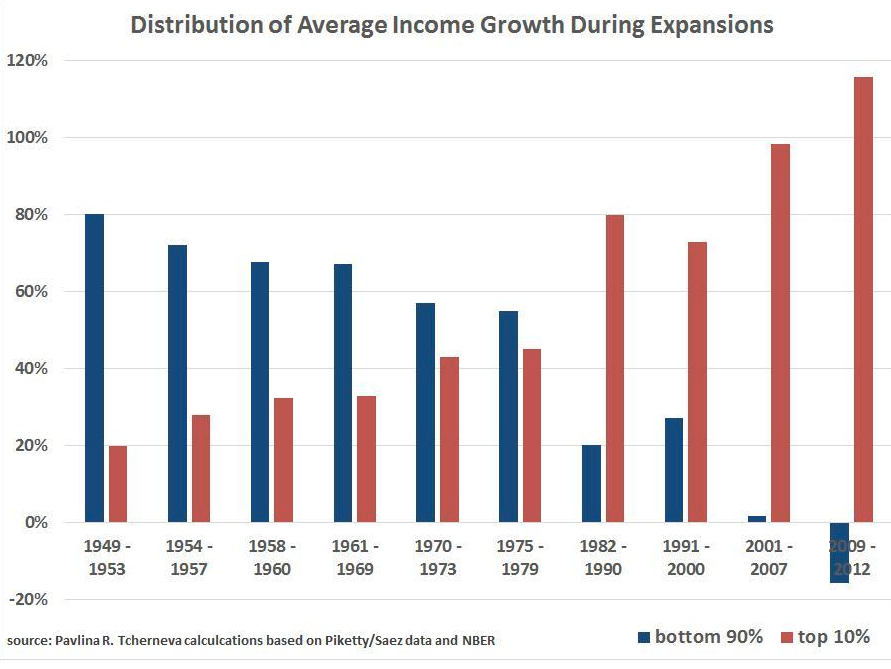

| During the past two expansions, only the better-off minority has seen an increase in their income - and the trend remains clear. |

|

| European purchasing manager indices did not show any growth ahead |

|

| The euro's weakness after the ECB's threats and plans of further monetary policy easing have largely been against the USD. Against AUD, JPY etc, the net change is zero. |

|

| Greece's stock index looks technically bad, but from a bit lower levels could provide a nice quick swing trade higher. |