|

| USD basis swap near crisis lows ZH |

Help request from Spain, but nothing official yet. Wednesday's ECB meeting, and to a much lesser extent the Thursday's speech by Bernanke are key events. I will post a collection of briefings for the ECB meeting tomorrow morning.

It’s the exact opposite of the classic Monty Python bit, where three cardinals burst upon a scene and yell “nobody expects the Spanish Inquisition!” Everybody expects a Spanish extrication – a bailout, a rescue, some kind of save from some international or multi-national source. – MarketBeat / WSJ

News –

Between The Hedges

Markets – Between

The Hedges

Recap – GlobalMacro Trading

The Closer

– alphaville / FT

Market

Commentary – A

View from My Screens

Tyler’s European Summary – ZH

Europe Treads Water Awaiting UK's Return To Reality

Tyler’s US Summary – ZH

Gold Wins As Financials And USD

Deteriorate

Debt

crisis: live – The

Telegraph

The Euro

Crisis Blog – WSJ

FX Options

Analytics – Saxo

Bank

European

10yr Yields and Spreads – MTS indices

EURO CRISIS: GENERAL

It is not Just Spanish Banks... – Marc

to Market

Given the rules of the engagement in Europe, if one is receiving assistance,

one is not responsible to provide assistance to others. This gives a first

mover advantage. If Spain goes before Cyprus, Cyprus perversely would have

to assist it.

It’s time for the US to express its dismay

at the lack of progress and to begin corralling world resources to incentivize Europe to solve its problems

Citi’s view

on ECB’s available tools: we are going

into the meeting expecting disappointment, but ready to be surprised if the ECB

takes a more aggressive stance.

Goldman Previews ECB "Hope For Best,

Prepare For Worst" – ZH

We expect the ECB to keep rates on hold this

Wednesday and also expect no announcement of further non-standard measures...but

would come out in force if needed

Uncollateralized Trillion Euro Perpetual Zero

Coupon – The Big

Picture

Very funny –

and sad.

EURO CRISIS: GERMANY

Nein! Nein! Nein! Again – The

Telegraph

Almost everything Angela Merkel is talking

about already exists. She has dressed up an old arrangement as if it were new. The

Commission knows this perfectly well. Everybody is pretending there was a

ground-breaking deal this week to maintain appearances. This is the usual EU

smoke and mirrors.

Schadenfreude Is a German Word – TF

Market Advisors

Is the German Pot Calling the PIIGS Kettle

Black? – Debt is either Repaid or It Isn't – How much is Germany on the Hook For at the ECB? – How much is Germany on the Hook For via the EFSF and EU and IMF? – How bad will German Bank

Losses Be? – How bad is the Target2 hit? – Countries in Glass Houses Shouldn’t

Throw Stones

Germany - The Ultimate Doomsday Presentation – ZH

Germany's opportunity cost to preserving the status quo right now, is at a cost of hundreds of billions in the future, yet even that pales to the cost of letting it all fall apart. But this was a year ago, and out of headlines means out of mind.

Germany's opportunity cost to preserving the status quo right now, is at a cost of hundreds of billions in the future, yet even that pales to the cost of letting it all fall apart. But this was a year ago, and out of headlines means out of mind.

EURO CRISIS: SPAIN

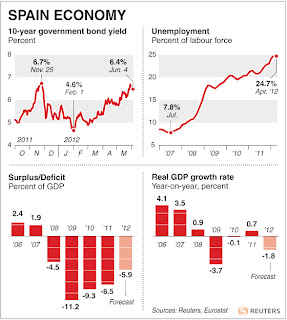

Spain has admitted for the first time that it needs European Union support to

prop-up its ailing banks, saying rising borrowing costs had shut the country

out of bond markets.

…flatly rejected the use of eurozone rescue

funds to recapitalise Spanish banks directly. Instead they called on the

Spanish government on Tuesday to decide urgently whether it will seek money

from the €440bn European Financial Stability Facility according to the fund’s

normal rules

Spaniards are shocked and disappointed at the

failure of the main parties and the country’s leading institutions to do

something about the economic crisis

EURO CRISIS: GREECE

Memo of Understanding and other Red Herrings – Marc

to Market

The framing of the Greek election around the

memorandum of understanding is such a red herring. There has been such

deterioration of the economic conditions in Greece that the conditions

and terms of its international assistance will have to be re-crafted in any

event.

There is "at least" a one-in-three

chance that Greece will leave the eurozone, credit rating agency Standard and Poor's has

warned.

OTHER

Arms races and the real encumbrance problem – alphaville

/ FT

Since the start of the US crisis of 2007, the

race for safety has replaced one of the other two races that Haldane discussed:

the race for returns, a catchy way to describe individual firms trying to

maximise profits while setting the stage for the collective market failure that

followed. (The other race, for speed, continues.)

Another Bear Awakens – Bruce

Krasting

Swiss

banker: money coming in from everywhere outside the US, but especially Russia

The Price of Inequality – Project

Syndicate

Joseph E. Stiglitz: America can no longer regard itself as the land of opportunity that it once

was. But it does not have to be this way: it is not too late for the American

dream to be restored.

Goldman On Housing's False Dawn – ZH

the large number of residential properties that are "underwater"—meaning the borrower owes more on the mortgage than the property is worth—casts a long shadow on the sustainability of the housing recovery.

the large number of residential properties that are "underwater"—meaning the borrower owes more on the mortgage than the property is worth—casts a long shadow on the sustainability of the housing recovery.