Monday, March 31

31st Mar - Disinflation in EZ

Yellen spoke (dovish), euro area's inflation in March fell to alarmingly low 0.5 percent (ECB meeting next Thursday) and a new book from Michael Lewis.

Sunday, March 30

Saturday, March 29

29th Mar - W/E: Best of the Week

Here

are the ”best” from my posts of the ending week. Last week’s edition here.

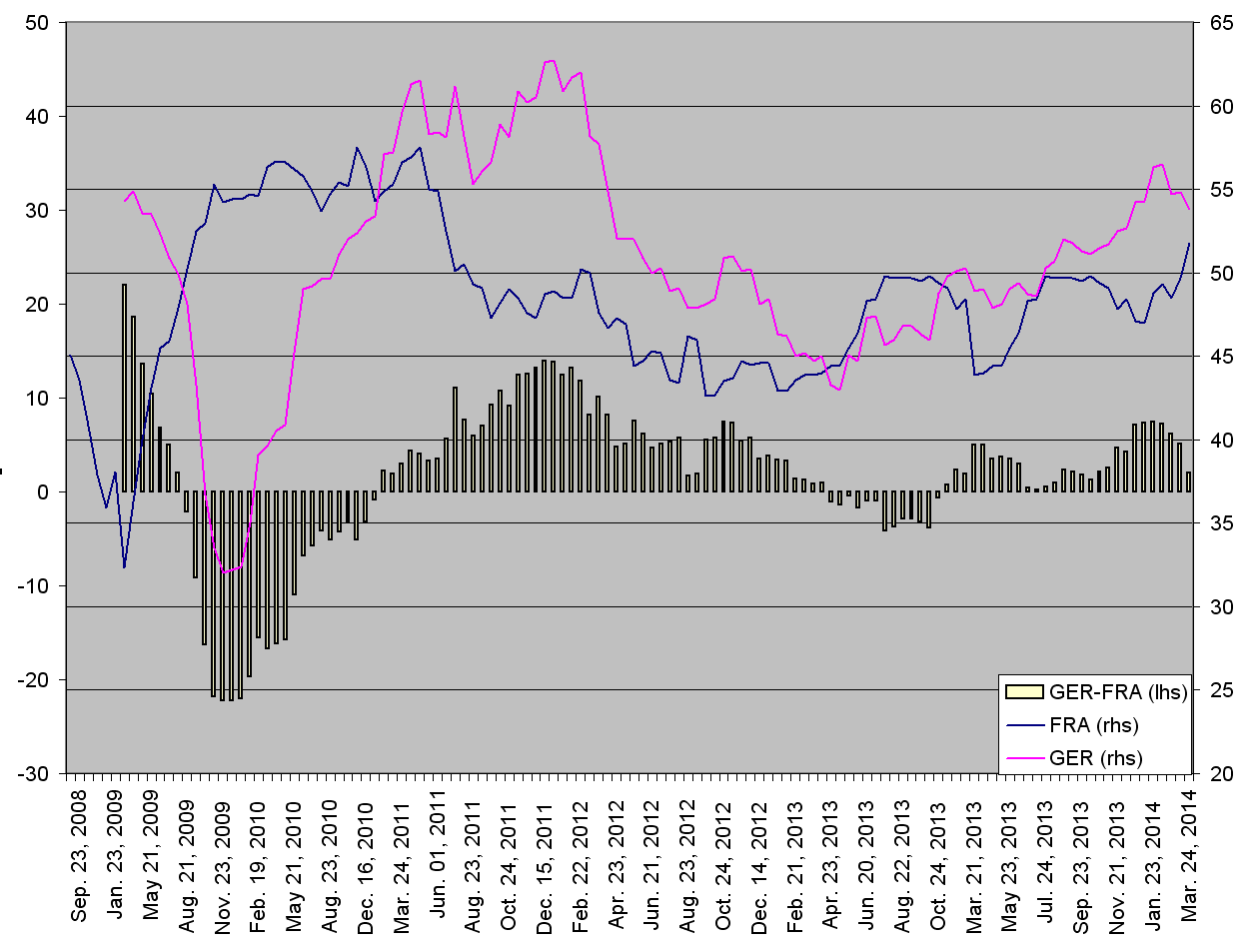

EUROPE: The divergence between France and Germany becoming smaller, expectations remain positive but inflation remains very low and looks weakish. ECB has gone extra-dovish in its comments, but Germans are sending fiscally tight messages and promising further integration - more iron maidens and "one size fits all"-policies, I guess. The IMF agreed on a big bailout of Ukraine, but the geopolitical situation remains open to further trouble.

US: Fed continues sounding hawkish, and no serious attempt to downplay the "six months after QE is over"-line that Yellen presented at the last FOMC meeting. The Fed is also being tight against the big banks, and probably thinks or at least is scared that the easy money has created an opportunity for another leverage-fest to build within the big banks.

ASIA: China's bad news continue, in fact the newsflow has been so bad that there have been speculation that easier monetary and/or fiscal policy would soon be announced to ease the pressures.

FINLAND: New austerity measures were launched to keep the country within the Maastricht criteria. The far left party Vasemmistoliitto left the government as a result.

Thursday, March 27

Wednesday, March 26

Tuesday, March 25

Monday, March 24

Sunday, March 23

Saturday, March 22

23rd Mar - W/E: Weekly Support

Here are the links to

the weekly roundups, reviews and also previews of the beginning week. Last

week's 'Support' here.

The week explained: March 21st 2014, by The Economist: Russia's annexation of Crimea, Janet Yellen's

first message from the Fed and George Osborne's new budget for Britain are three important

stories that made the news this week.

Friday, March 21

Thursday, March 20

Wednesday, March 19

19th Mar - Special: China

As requested, here's something on China.

What makes this chart so special: 2000-2008 export-led growth. When crisis hit, domestic credit was increased massively. Now there is no large export surplus, and debt is very high. No way out but to deleverage slowly. Also means no more fixed investments for a long time. Banks' bad loans at post-crisis high.

Tuesday, March 18

Monday, March 17

Sunday, March 16

Saturday, March 15

15th Mar - W/E: Weekly Support

Here are the links to

the weekly roundups, reviews and also previews of the beginning week. Last

week's 'Support' here.

Friday, March 14

Thursday, March 13

Wednesday, March 12

Tuesday, March 11

Monday, March 10

Sunday, March 9

Saturday, March 8

8th Mar - W/E: Weekly Support

Here are the links to

the weekly roundups, reviews and also previews of the beginning week. Last

week's 'Support' here.

Friday, March 7

Thursday, March 6

6th March - ECB Meeting

The interest rate decision will be announced at 12.45 GMT, the press

conference will begin at 13.30 GMT and the video feed can be watched here. The introductory statement will be posted here shortly after its presentation.

After the break, here are the ECB previews:

Wednesday, March 5

5th Mar - High yieldistä ??meli-nimimerkille

Jenkkien valtion kymppivuotinen korko on todennäköisesti pohjat nähnyt. Ehkä tuossa olisi vielä yksi legi jäljellä tulla alas, mutta tuskin mennään enää uusiin pohjiin.

Jenkkien valtion velkakirjojen ja high yield-firmojen korkopaperien välinen spread on hyvin alhainen. Kaksi edellistä pohjakosketuysta oli 1998 2.5% ja 2005-2007 samaten 2.5%. Korkospreadilla on varaa laskea vielä, mutta pomppu (kuten kävi 2011) alkaa olla todennäköisempi vaihtoehto kuin lasku näillä tasoilla.

Selvennyksenä, että high yield-paperin korkotuotto määräytyy kahdesta tekijästä - riskittömästä korosta (US valtionpaperin korko) ja riskilisästä. Kumpikin komponentti kertoo, että korko voi vielä vähän laskea, mutta pikemminkin nousuun kannattaa varautua.

HYG eli high yield-ETF ei ole liikkunut 2010 lähtien oikein mihinkään. Teknisesti saattaisi käydä jossain 98-tasoilla eli vähän ylempänä, n. 90-taso alhaalla päin toiseen suuntaan.

Tässä sen huomaa, mitä alhaiset korot tekevät: HYG ei ole 2010 jälkeen tuottanut mitään, mutta osakkeet lähtivät kirittämään kunnolla. HYG:llä ei vain ole ollut nousuvaraa, koska korot ovat niin alhaalla.

Tuesday, March 4

Monday, March 3

Sunday, March 2

Saturday, March 1

1st Mar - W/E: Weekly Support

Here are the links to

the weekly roundups, reviews and also previews of the beginning week. Last

week's 'Support' here.

Subscribe to:

Comments (Atom)